Rethink your finance and operations to prepare for the new normal

Craig Jackson explores the steps organisations are taking in response to the pandemic and explains BDO's 'Rethink' model.

Date: 18th Jun 2020

Author: Craig Jackson, BDO

In the second in a series of blogs from BDO exploring the support package created with Sport England and UK Sport for funded partners, Craig Jackson looks at the steps organisations are taking in response to the pandemic and explains BDO's 'Rethink' model.

‘Where is our future income going to come from? How can we reduce the impact of losses from cancelled events? Is there any unnecessary expenditure that can be cut to support our financial position?’

Like all sports organisations dealing with the Covid-19 outbreak, such questions will be at the forefront of your discussions. Only in February 2020, when it was still business as usual, annual plans and budgets were being finalised and the indications were that prolonged periods of staff sickness would be the most significant challenge for many businesses. By March, many were grappling with the reality of a lengthy period of restrictions that would significantly disrupt day-to-day operations. Sporting organisations large and small have been considerably affected, with nearly all being forced to temporarily suspend operations for a number of months.

Boards have had to respond quickly, working cohesively to provide strong leadership. Some Boards may be adopting a more operational role, recognising the need for considered but quick decisions and actions. Board and management effectiveness is enhanced where organisations have good governance in place, including an emergency team established to monitor the changing landscape. Access to reliable data on your financial position, members (customers) and stakeholders is also vital for effective decision making.

Applying BDO’s Rethink model

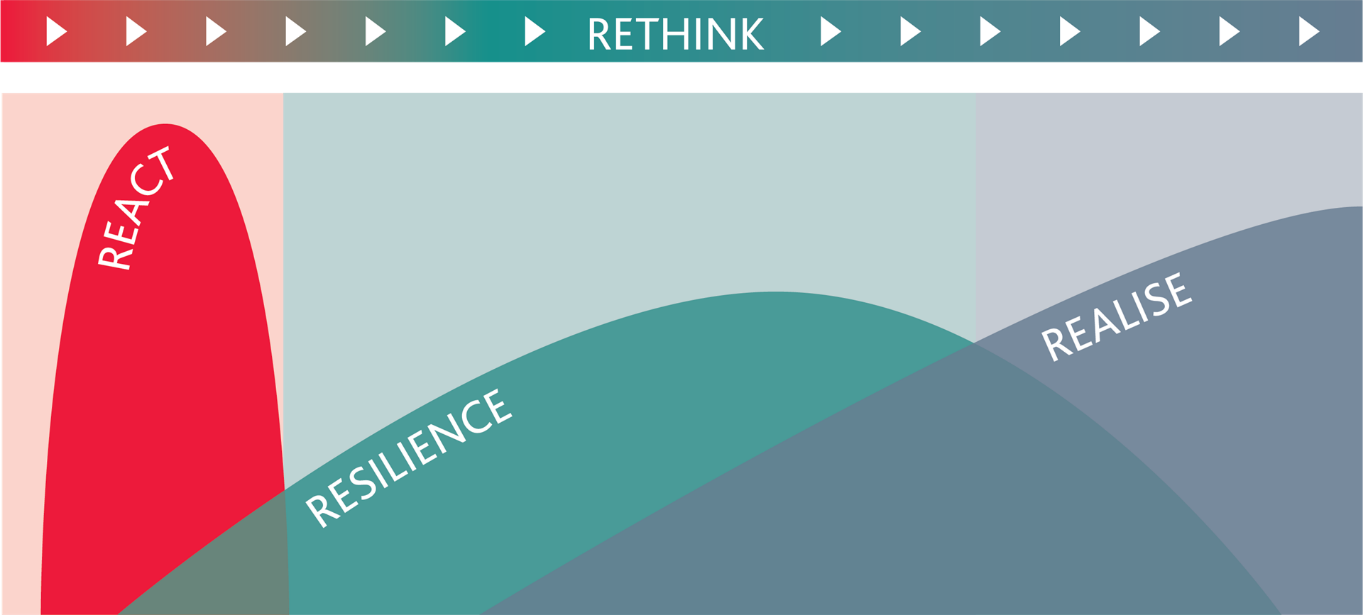

Strong governance also depends on a sound control environment – a vital requirement to help sports organisations manage the challenges created by Covid-19. BDO’s Rethink model outlines an effective approach to adapting organisations’ control environment – moving from the initial reaction phase right through to the return of operating in the ‘new normal’ environment.

REACT - responding to the changed circumstances

Although the initial ‘react’ phase began some time ago, some core actions are ongoing and lessons can still be learned.

Due to uncertainty over the length and types of disruption caused by the Covid-19 outbreak, sports organisations were forced to focus on the short and medium term. Understanding the current cash position became critically important. Finance teams have been preparing short-term (13 week) cash flow forecasts that are subject to ongoing review to ensure they reflect the most recent financial position. These may be supplemented with updated business planning and re-forecasted budgets to ensure the current liquidity position is carefully monitored and managed. Organisations are also producing management accounts more regularly to ensure they take decisions using the most up-to-date information.

After understanding the initial cash position and short/medium-term liquidity requirements, a key next step was to stress test variables and assumptions through sensitivity analysis and scenario-planning exercises. For example, what happens if 'business as usual' doesn’t return for three, six or 12 months? What if it never returns?

Understanding the current cash position and forecasting cash flow levels based on a range of variables, assumptions and scenarios provides Boards with critical information to make key decisions. Steps your organisation could benefit from, if not already taken, include:

- Understanding all short-term liabilities, contracts and covenants and working across supply chains to find mutually agreeable solutions

- Completing scenario planning and sensitivity analysis to review cash flow forecasts using each revised assumption

- Ensuring management accounts are updated on a weekly basis and monitored against your revised cash flow forecasts

- Considering measures to reduce variable cost bases, as well as revenue drivers that could be enhanced

- Reforecasting budgets where necessary and ensuring variance analysis is completed in detail to inform future financial decisions

- Enhancing key financial controls around payables and receivables and working with your supply chain

- Forecasting the use of reserves to bridge short-term liquidity issues – ensuring you clearly outline a worst case scenario and predict when reserves could be depleted if this occurs.

For all organisations, regular discussions of the financial position are essential. Income streams should be given a risk rating, with specific actions identified for mitigating risks.

RESILIENCE - managing your financial position and liquidity

Having understood the short- and medium-term financial requirements, Boards are able to take the action necessary to maintain or enhance their organisation’s position. This includes identifying any opportunities to access additional funding or reduce costs. Strategies that can be adopted include:

Using Government help schemes

Small organisations can access schemes such as the Direct Business Grant and the Bounce Back Loan, as well as benefiting from local business rates waivers. Funded partners can apply for emergency funding through the Sport England Community Fund. Larger sporting organisations have been able to furlough non-public funded staff through the Government’s furlough scheme, as well as having access to additional funding streams through the Business Interruption Loan Scheme and the Corporate Financing facility.

Strengthening the internal control environment

Due to the ongoing disruption, you should ensure that key internal and external documents, such as bank mandates and schemes of delegation, are up to date, accurate and include contingencies to combat short notice staff absence. The liquidity issues caused by the disruption and the heightened risk of fraud have highlighted the ongoing importance of ensuring robust accounts payable and receivable controls are in place and operating effectively.

Reviewing business operations

Many clients have worked with their supply chains to amend pricing and payment structures or to increase debtor or creditor days where possible. Organisations are also focusing attention on revenue streams, particularly membership fees. Some have felt the need to freeze membership fees, but others have offered future discounts in return for continued payments to sustain cash flows. Smaller sport and charitable organisations have used reserves where necessary to offset reductions in income. Some larger sports organisations have offered supporters the chance to donate balances owed to other smaller local associations and clubs.

Other actions your organisation could consider taking include:

- Contacting your bank to assess overdraft arrangements to support liquidity

- Engaging with utility providers to discuss deferring payments or temporarily changing payment models from fixed to variable as office space is not utilised

- Assessing stock you hold, identifying items that may become obsolete or that could generate cash now if hired out or sold

- Talking to commercial stakeholders to understand their perspective and likely future engagement

- Reviewing insurance arrangements to assess if they are still fit-for-purpose or can be modified to generate immediate cash benefits for your organisation.

Managing VAT

HMRC has provided various VAT deferral and relief schemes to improve organisations’ cash flow during the Covid-19 disruption. VAT considerations for the sports sector will be considered in a separate blog, including information on the BDO support available, such as a VAT health check.

REALISE - moving to a new normal

As the Government continues to open up both society and the economy, sports organisations face new risks that need effective management. The following key steps could help your organisation navigate this period successfully:

- Constantly monitor key health and economic information, as well as Government policy, to update your short- and medium-term financial models and business plans

- Communicate plans and decisions to an implementation team, setting clear KPIs and monitoring the progress of key tasks on a regular basis

- Align your response with clear internal and external communication plans to ensure that staff, customers, clients, members and supporters all receive consistent and regular information updates

- Plan for longer-term disruption and ensure all medium- to long-term assumptions and variables are robustly stress tested

- Continuously review areas where additional funding can be accessed or where innovative new revenue streams can be opened or enhanced.

Craig Jackson is a Manager at BDO. If you would like to speak to a member of the BDO team about the help available or review other Covid-19 guidance please visit our dedicated microsite here.